Get the most up-to-date data and insights into shipping volumes and the cost of freight. See how they change each month and understand the market forces behind them.

| November 2022 | Year-over-year change | 2-year stacked change | Month-to-month change | Month-to-month change (SA*) | |

| Cass Freight Index - Shipments | 1.201 | -0.4% | -1.9% | -1.9% | -0.5% |

| Cass Freight Index - Expenditures | 4.476 | 4.7% | 50.7% | 1.8% | 3.9% |

| Cass Inferred Freight Rates | 3.727 | 5.1% | NA | 3.7% | 4.4% |

| Truckload Linehaul Index | 152.1 | 1.7% | 11.4% | -1.2% | -- |

* SA = seasonally adjusted

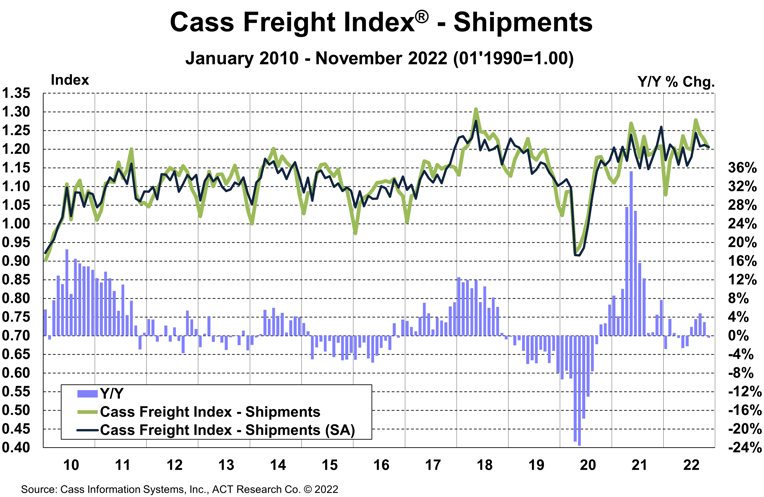

The shipments component of the Cass Freight Index® fell 0.4% y/y in November. On a m/m basis, the index fell 1.9%, or 0.5% on a seasonally adjusted (SA) basis.

Sharpening declines in imports, into the West Coast in particular, suggest near-term trends could soften further. Normal seasonality from here would have shipments down 5% y/y in December and about flat for the year.

See the methodology for the Cass Freight Index.

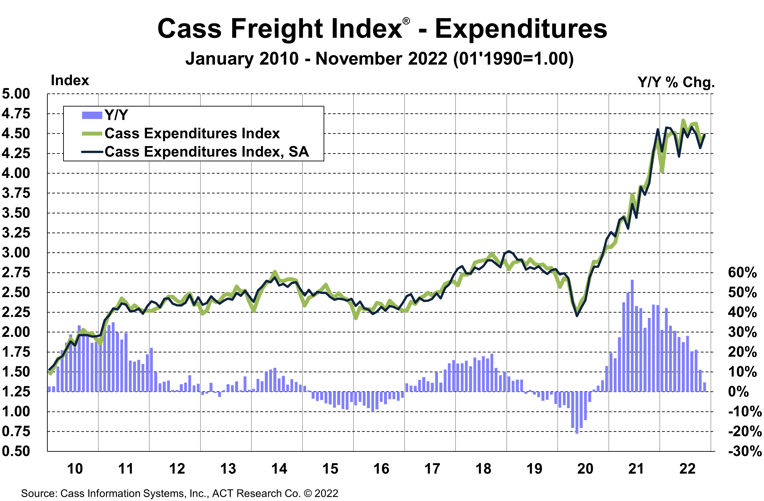

The expenditures component of the Cass Freight Index, which measures the total amount spent on freight, rose 4.7% y/y in November, slowing from an 11.1% increase in October.

Expenditures rose 1.8% m/m after a 4.9% drop in October. Against a shipment decline of 1.9% m/m in November, we can infer that rates overall were up 3.7% (see our inferred rates data series below). The increase in rates m/m appears mainly due to changes in modal mix.

This index includes changes in fuel, modal mix, intramodal mix, and accessorial charges, so is a bit more volatile than the cleaner Cass Truckload Linehaul Index®.

Following normal seasonality from here, this index is now likely to be flattish on a y/y basis in December and end the year with a 23% increase.

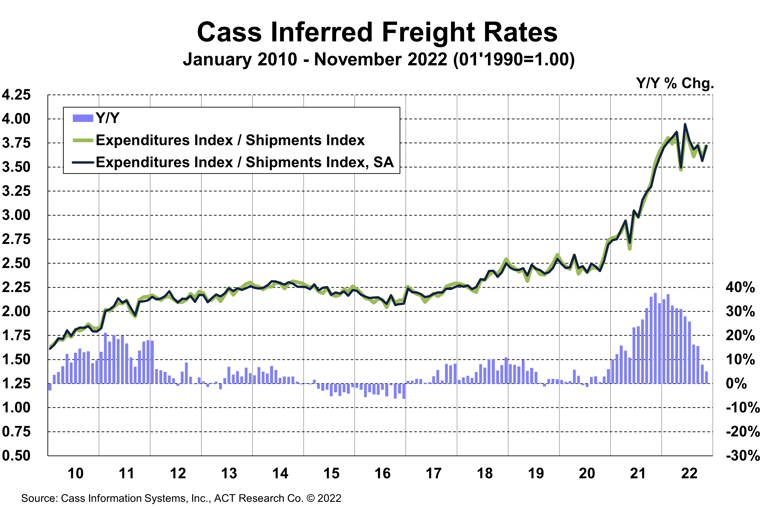

The slowdown in freight rates continued this month, with the rates embedded in the two components of the Cass Freight Index® slowing to 5.1% y/y growth in November, from 7.9% y/y growth in October.

The supply/demand balance in U.S. trucking markets has loosened significantly this year, and as a result freight rates are leveling off and set to soften further in the months to come.

The normal seasonal pattern would have this index turning down on a y/y basis in February 2023, but it could happen sooner given market conditions.

Shippers are starting to see real savings and considerable cost relief is now likely for 2023, which should be increasingly positive news for the complex inflation picture.

Cass Inferred Freight Rates are a simple calculation of the Cass Freight Index data—expenditures divided by shipments—producing a data set that explains the overall movement in cost per shipment. The data set is diversified among all modes, with truckload representing more than half of the dollars, followed by LTL, rail, parcel, and so on.

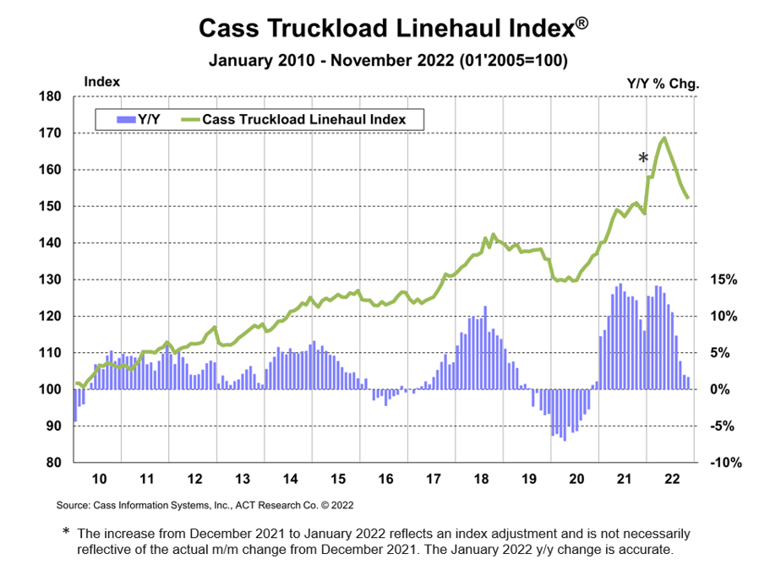

The downtrend in truckload linehaul rates completed its sixth month in November, as the Cass Truckload Linehaul Index slowed to a 1.7% y/y increase from 2.0% in October.

See the methodology for the Cass Truckload Linehaul Index.

To mix it up from our usual freight market discussion in this last month of the year, we’d like to address a question that arose after Tesla recently announced its first 500-mile journey in a Semi electric tractor with an 81,000-lb. load.

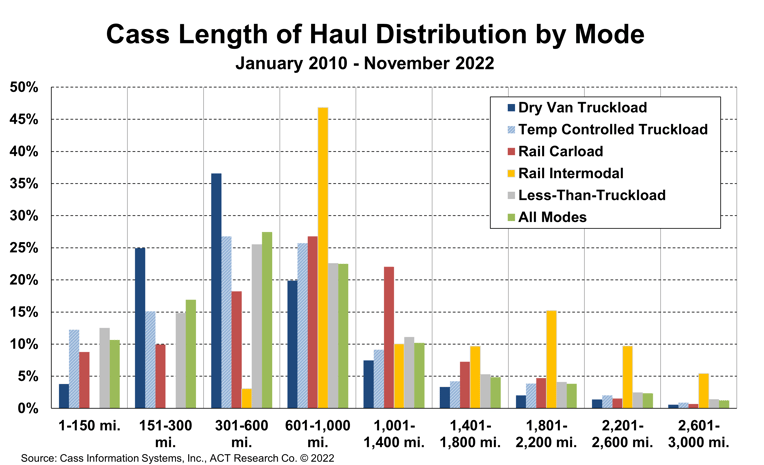

We broke down the Cass database by mode and mileage to see specifically what proportion of shipments in each mode fall into each mileage bucket, and the results are below. While we’d of course love smaller buckets, the chart below represents an excellent sample of about 120 million shipments.

In the dry van truckload market, the heart of the industry where the Semi is targeted, about 47% of shipments are under a 450-mile length of haul. Just 4% of shipments are under 150 miles, and another 25% are under 300 miles. We have to slice our 301-600 mile bucket to answer the question, and we’ll err on the side of caution considering the 500-mile range seems more like a stretch than a normal operation and take half of that 37% bucket. Adding it up, about 47% of dry van shipments are likely addressable by the Semi.

In the reefer, or temp-controlled, truckload market, about 40% of shipments are under a 450-mile length of haul. A larger share, 12% of shipments are under 150 miles and 15% are 150-300 miles. But with more long-haul, we estimate using the same logic as above that 41% of the reefer market is under 450-miles, and with refrigeration energy to account for, a lower threshold is appropriate, though the reefer unit makers have creative ways to support electrification as well. About 40% of LTL is under the 450-mile threshold as well.

We expect the more local shipments, like snacks and drinks, to be the first to electrify, and even though payback periods for EVs have fallen this year as diesel prices surge and inventories remain fairly tight, the overall economics haven’t improved much because of higher electricity and battery costs, though the $40k per unit incentive in the Inflation Reduction Act helps.

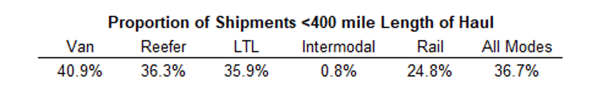

If we take a fleet manager’s perspective, the need for a larger safety buffer would suggest the vehicle should only go into shorter applications for a while. But if we take the buffer to 20% and ask the database what proportion of shipments are less than a 400-mile length of haul, we find about 37%. How many shipments does that mean every year in the U.S.? That’s not one anyone can answer with any precision, but our best guess is around 150 million shipments.

Now that the pendulum has swung from fleets to shippers, some crucial questions about the freight rate cycle have been raised: How long? And when will it turn? The ACT Research Freight Forecast report provides monthly, quarterly, and annual predictions for the truckload (TL), less-than-truckload (LTL), and intermodal markets through 2024, including capacity, volumes, and rates. The report provides monthly updates of forecasts for the shipments component of the Cass Freight Index and the Cass Truckload Linehaul Index, as well as DAT spot rates by trailer type, including and excluding fuel surcharges.

Release date: We strive to release our indexes on the 12th of each month. When this falls on a Friday or weekend, our goal is to publish on the next business day.

Tim Denoyer joined ACT Research in 2017, after spending fifteen years in equity research focused primarily on the transportation, machinery, and automotive industries. Tim is a senior analyst leading ACT’s team transportation research effort, and the primary author of the ACT Freight Forecast, U.S. Rate and Volume Outlook. Research associate Carter Vieth, who joined ACT in early 2020 after graduating from Indiana University, also contributes to the report. This report provides supply chain professionals with better visibility on the future of pricing and volume in trucking, the core of the $1.06 trillion U.S. freight transportation industry, including truckload, less-than-truckload, and intermodal.

Tim also plays roles in ACT Research’s core Class 4-8 commercial vehicle data analysis and forecasting, in powertrain development, such as electrification analysis, and in used truck valuation and forecasting. Tim has supported or led numerous project-based market studies on behalf of clients in his four years with ACT Research on topics ranging from upcoming emissions and environmental regulations to alternative powertrain cost analyses to e-commerce and last-mile logistics to autonomous freight market sizing.

ACT’s freight research service leverages ACT’s expertise in the supply side economics of transportation and draws upon Tim’s background as an investment analyst, beginning at Prudential and Bear Stearns. Tim was a co-founder of Wolfe Research, one of the leading equity research firms in the investment industry. While with Wolfe, Tim was recognized in Institutional Investor’s survey of investors as a Rising Star analyst in both the machinery and auto sectors. His experience also includes responsibility for covering the industrial sector of the global equity markets, including with leading investment management company Balyasny Asset Management.

The material contained herein is intended as general industry commentary. The Cass Freight Index, Cass Truckload Linehaul Index (“Indexes”), and other content are based upon information that we consider reliable, but Cass does not guarantee the accuracy, timeliness, reliability, continued availability or completeness of any information or underlying assumptions, and Cass shall have no liability for any errors, omissions or interruptions. Any data on past performance contained in the Indexes is no guarantee as to future performance. The Indexes and other content are not intended to predict actual results, and no assurances are given with respect thereto. Cass makes no warranty, express or implied. Opinions expressed herein as to the Indexes are those of Stifel and may differ from those of Cass Information Systems Inc. All opinions and estimates are given as of the date hereof and are subject to change.

© Copyright 2023 Cass Information Systems, Inc.