Topics: Economic Shifts, Equipment Financing, Carrier Newsletter, CassFreightIndex

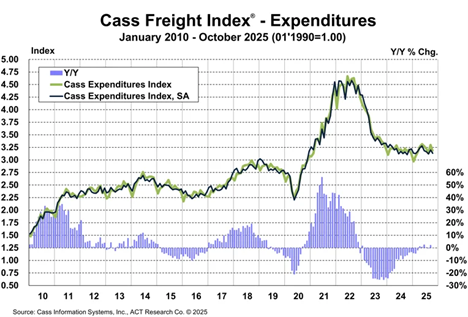

The Cass Freight Index for October illustrates that fleets continue to struggle financially as shipments dropped 4.3% month over month and expenditures fell 3.9%.

“The public TL fleets’ margins are at generational lows and unable to find traction in 2025,” wrote ACT Research’s Tim Denoyer. “Highway tractor capacity is contracting at a quickening pace, both due to ongoing closures in the for-hire market, and more recently the reversal of private fleet expansion. The issue for the freight cycle is now the affordability reductions that tariffs are beginning to impose on U.S. consumers. These taxes could be mitigated if the Supreme Court upholds rulings that the IEEPA tariffs are unconstitutional, which seems possible after oral arguments.”

Cass Information Systems provides the most up-to-date data and insights into shipping volumes and the cost of freight in our monthly Transportation Index Report. Get the latest insights here.

OEMs

Class 8 Truck Orders Drop 22%

Class 8 truck orders fell 22% year over year in October, marking the 10th consecutive month of annual declines.

“Combined net orders for September and October are 32% below year-ago levels, highlighting persistent weakness in freight fundamentals and limited carrier profitability,” Dan Moyer, FTR Transportation Intelligence’s senior analyst of commercial vehicles, said, according to the Commercial Carrier Journal (CCJ).

Order volumes aren’t expected to rebound until freight volumes and rates improve. Moyer said carriers are prioritizing “cost control and asset utilization over growth, delaying a meaningful rebound in equipment demand until economic and market conditions stabilize.”

Volvo Moves Closer to Driverless Truck Operations

Trucking Dive reported that Volvo Autonomous Solutions may be only quarters away from removing safety drivers from its trucks operating in the United States.

Volvo currently is operating five autonomous trucks between Dallas and Houston as well as between Fort Worth and El Paso.

Sasko Cuklev, Volvo’s head of on-road solutions, said at the American Trucking Associations’ Management Conference & Exhibition in late October that he sees autonomous vehicles potentially becoming a new mode of delivering freight alongside rail, ships, and manned trucks.

“It is not only about an autonomous truck,” Cuklev said. “So there is a broader, bigger solution that needs to be in place and an ecosystem, and that we have set up in Texas.”

Carriers

‘Supply-Driven Change in the Market’ Needed for Trucking Recovery

Bob Costello, the ATA’s chief economist, said at last month’s conference that “new tariffs, persistent stagflation, and a slowing labor market have created ‘absolutely unsustainable’ conditions for many carriers, and the only way out, at least near-term, is to erase capacity from the highway,” according to the CCJ.

Costello doesn’t expect freight demand to improve anytime soon. “This has got to be a supply-driven change in the market,” he said.

He said while supply has been slow to leave the market, carrier exits could accelerate as more banks call more notes and enforcement of English Language Proficiency (ELP) regulations increases.

40% Drop in Cross-Border Loads Expected

Carriers operating at the California-Mexico border expect a 40% drop in U.S.-bound loads by the end of the year, according to CDL Life.

While there is normally a spike in U.S.-bound deliveries from Mexico in October and November, trucking companies have seen a significant drop this year.

“Our activities as transport companies, as we enter this 11th month of the year, we can say it’s been an unfortunate year,” Alfonso Millán Chávez, of the Northern Baja California Chamber of Freight Transporters, was quoted as telling CBS 42.

Economy Tops Trucking Industry Concerns

The economy topped the list of trucking industry concerns for the third year in a row. But four new topics — ELP, 2027 diesel emissions regulations, driver training standards, and artificial intelligence (AI) — made their way into the American Transportation Research Institute’s (ATRI) latest Top Industry Issues report.

The ATRI gathered input from more than 4,200 trucking industry stakeholders for the annual report.

It also breaks responses down by segment, showing truck drivers’ top concerns were compensation, trucking parking, and ELP, while carriers’ top issues were the economy, lawsuit abuse reform, and insurance cost and availability.

Forward Air Reports 34% Operating Income Drop

Forward Air’s third-quarter operating income dropped about 34% year over year to $15 million.

The biggest loss — about $18.3 million — came in the Other Operations segment, which posted a loss of nearly $1.8 million in Q3 2024.

“Optimizing our cost structure to operate more efficiently remains a top priority, and in the third quarter we implemented additional cost reduction initiatives that primarily included rightsizing our business in alignment with current freight demand and our ongoing transformation strategy,” Forward Air CEO Shawn Stewart said in an earnings release.

Forward Air has struggled since its lawsuit-filled acquisition of Omni Logistics in early 2024. Company leaders reportedly are considering a sale or merger.

Crime

Cargo Theft Cases Dip in Third Quarter

The number of cargo thefts in the third quarter actually decreased 10% from the second quarter, according to CargoNet.

CargoNet recorded 772 cargo theft incidents in the United States and Canada in Q3, just a 1% increase from the third quarter of 2024.

Still, the value of stolen goods in Q3 was pegged at a hefty $118.8 million, driven by organized crime groups targeting high-value shipments of enterprise computer hardware, cryptocurrency mining equipment, and copper products, the CCJ said. And the average stolen shipment value doubled year over year from $168,448 in Q3 2024 to $336,787.

Despite the overall decrease, cargo theft incidents jumped 110% in New Jersey and 33% in Pennsylvania.

“The NYC metro area is emerging as both a primary location for theft activity and a destination for stolen goods,” Keith Lewis, CargoNet’s VP of operations, said. “Organized crime groups are exploiting the region’s dense logistics network and proximity to major consumer markets.”

Technology

Roadrunner Uses AI to Slash Missed Pickup Rate

The CCJ reported that Roadrunner implemented AI and data-driven processes to slash its missed pickup rate from 30% five years ago to just .5% today.

Roadrunner President and COO Tomasz Jamroz said the massive improvement was “driven by processes, change of people, and technology. The AI that we introduce now, which is fairly new for us in the area of pickup and delivery, is really how we’re aiming to get to the point that we don’t have a single missed pickup.”

Roadrunner also recently deployed new pickup and delivery software with advanced track-and-trace capabilities, and Jamroz expects the carrier will take its missed pickup rate down to zero.

“To get it really to zero, you really need to have better tech,” he said. “So what this is going to do is, let’s say I get a pickup and the truck broke down. The system automatically will recognize all my trucks in the network — all the routes in the network — to maximize the chances that the load is still picked up successfully on time.”

Warehousing

Tariff Uncertainty Drives Up Warehouse Demand

Supply Chain Dive reported that demand for U.S. industrial real estate space surged in the third quarter, with the biggest jumps in the Phoenix and Indianapolis markets, “driven by strong big-box activity, build-to-suit deliveries, and large user sales.”

Net absorption, or the change in occupied space, was 60 million square feet, a year-over-year increase of nearly 20 million square feet, and the highest level since the first quarter of 2023.

Logistics real estate firm Prologis said it is seeing particularly strong demand among e-commerce companies and businesses investing in their supply chains to improve service and manage costs.

“Customers have definitely become more desensitized to the short-term noise as they look at making long-term decisions,” Prologis President Dan Letter said. “It’s great to see these well-capitalized large companies leading the way because we typically see the small and medium businesses follow suit here.”

Cass Equipment Financing

Cass Commercial Bank Equipment Financing finances trucks, trailers, and equipment. Contact Scott Williams, Vice President Commercial Equipment Finance, at (513) 545-4605 or swilliams@cassbank.com to learn more.

Why Q4 Is a Strategic Time for Equipment Financing

As the year winds down, the fourth quarter presents unique advantages for leasing or purchasing equipment. Here’s how businesses can turn timing into value:

💰 Maximize Tax Efficiency

- Accelerated Depreciation: Buyers can leverage 100% bonus depreciation while only recording a fraction of the year’s taxable income, amplifying the economic impact.

- End-of-Year Tax Planning: Equipment ownership benefits remain constant, but their value increases when applied against year-end financials.

📊 Optimize Budget Utilization

- Use It Before You Lose It: Many purchasing budgets expire at year-end. Q4 is the last window to deploy remaining funds strategically.

🤝 Leverage Seller Incentives

- Year-End Sales Goals: Sellers are motivated to close deals before December 31, often offering better terms or pricing to hit annual targets.

📅 Strategic Timing for Lease Terms

- Push End-of-Term into Next Tax Year: Structuring leases to end in a future tax year can improve cash flow and optimize financial reporting.

📈 Protect Against Price Increases

- Lock in Current Rates: Financing now helps hedge against potential equipment price hikes in the new year.

🚚 Boost Holiday Capacity

- Meet Seasonal Demand: For retail and logistics, Q4 equipment purchases can increase throughput during peak season.

🔄 Improve Financial Presentation

- Recapitalize or Refinance: Q4 is a smart time to restructure debt or refinance equipment, enhancing cash flow and balance sheet optics before year-end reporting.