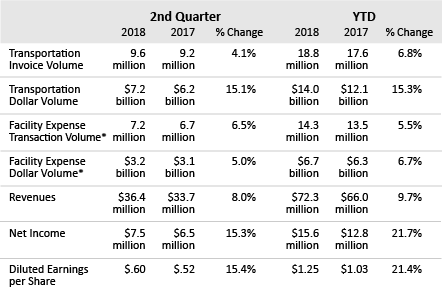

ST. LOUIS - July 26, 2018 - Cass Information Systems, Inc. (NASDAQ: CASS), the nation’s leading provider of transportation, energy, telecom and waste invoice payment and information services, reported second quarter 2018 earnings of $.60 per diluted share, an increase of 15% from the $.52 per diluted share it earned in the second quarter of 2017. Net income for the period was $7.5 million, compared to $6.5 million in 2017.

2018 2nd Quarter Recap

The increase in revenue and net income of 8% and 15%, respectively, was driven by the continued expansion of the customer base; the development and deployment of new revenue generating services; higher interest rates; and tax reform. The solid bottom-line advances were achieved despite significant expenditures in personnel, technology and infrastructure to support future service growth.

Highlighting second quarter performance was a 15% increase in transportation dollar volume. Higher carrier and fuel prices, in tandem with higher volume from current accounts, produced the positive result. Transportation invoice volume for the period was up 4%.

Facility-related (electricity, gas, waste and telecom expense management) dollar volume was up 5% with facility expense transaction volume up 7%. Again, new customer wins plus higher volume from current accounts generated the favorable outcome.

Consolidated operating expenses increased $2.6 million (10%) due mainly to on-going strategic investment in the technology and staff required to win and support new business.

“We are pleased to report these solid second quarter results,” stated Eric H. Brunngraber, Cass chairman and chief executive officer. “Our focus is to make internal investments now that will position the company to capitalize on growth opportunities we see emerging over the longer term.”

2018 Earnings Up 21% at Six-Month Mark

For the six-month period ended June 30, 2018 the company earned $1.25 per diluted share, an increase of 21% from the $1.03 per diluted share it earned in the same period in 2017. Net income was $15.6 million, compared to $12.8 million in 2017. Revenues rose 10%, from $66.0 million in 2017 to $72.3 million in 2018.

Consolidated operating expenses were up 9%, or $4.4 million, due to increased business and the strategic decisions previously cited.

Cash Dividend Declared

On July 24, 2018, the company’s board of directors declared a third quarter dividend of $.26 per share payable September 14, 2018 to shareholders of record September 4, 2018. This third quarter dividend sustains the new higher level set by the board in the second quarter. Cass has continuously paid regularly scheduled cash dividends since 1934.

About Cass Information Systems

Cass Information Systems, Inc. is a leading provider of integrated information and payment management solutions. Cass enables enterprises to achieve visibility, control and efficiency in their supply chains, communications networks, facilities and other operations. Disbursing $50 billion annually on behalf of clients, and with total assets exceeding $1.5 billion, Cass is uniquely supported by Cass Commercial Bank. Founded in 1906 and a wholly owned subsidiary, Cass Bank provides sophisticated financial exchange services to the parent organization and its clients. Cass is part of the Russell 2000®. More information is available at www.cassinfo.com.

Note to Investors

Certain matters set forth in this news release may contain forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results to differ materially from those in such statements. For a discussion of certain factors that may cause such forward-looking statements to differ materially from the company’s actual results, see the company’s reports filed from time to time with the Securities and Exchange Commission including the company’s annual report on Form 10-K for the year ended December 31, 2017.

Additional financial details are available here.