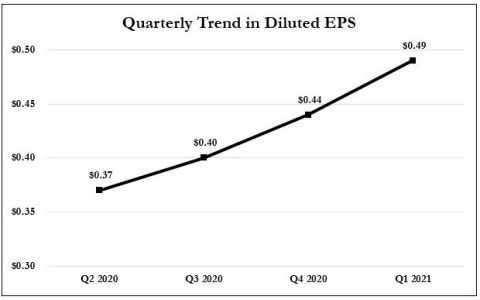

ST. LOUIS--(BUSINESS WIRE)--Apr. 22, 2021-- Cass Information Systems, Inc. (Nasdaq: CASS), the leading provider of transportation, energy, telecom, and waste invoice payment and information services, reported first quarter 2021 earnings of $.49 per diluted share, an increase of 32.4% from the pandemic-induced low of $.37 per diluted share it earned in the second quarter of 2020.

Earnings Recovery Continues at Cass Information Systems (Graphic: Business Wire)

Net income for the period was $7.1 million compared to $5.4 million earned in the second quarter of 2020, when the negative economic impact of the pandemic was most pronounced on Cass and its customers. The improvement in earnings was achieved despite the near-zero overnight interest rate environment since the onset of the pandemic in March 2020.

When compared to the first quarter of 2020, which largely transpired prior to the full impact of the pandemic, diluted earnings per share declined 5.8%. Key volume and financial data comparing quarters is as follows:

|

|

March 31, 2021 |

March 31, 2020 |

% |

|

Transportation Invoice Volume |

8.8 million |

8.3 million |

6.1 |

|

Transportation Dollar Volume |

$7.9 billion |

$6.5 billion |

22.2 |

|

Facility Expense Transaction Volume* |

7.0 million |

6.5 million |

7.5 |

|

Facility Expense Dollar Volume* |

$3.7 billion |

$3.5 billion |

7.5 |

|

Revenues |

$37.1 million |

$38.1 million |

(2.7) |

|

Net Income |

$7.1 million |

$7.5 million |

(6.3) |

|

Diluted Earnings Per Share |

$.49 |

$.52 |

(5.8) |

* Includes Energy, Telecom and Waste

Transportation invoice and dollar volumes improved 6.1% and 22.2%, respectively. Fueling the increases were the stronger performance of the manufacturing sector quarter over quarter and new customer wins over the past 12 months. Further improvement in dollar volume resulted from scarcity in carrier supply, which drove prices higher.

Facility-related (electricity, gas, waste and telecom expense management) invoice and dollar volumes both increased 7.5% with the increases attributable, in part, to new business wins.

Revenues declined 2.7% quarter over quarter as a result of a decrease in gains on the sale of securities of $1.0 million, in addition to the continued negative impact of the historically low short-term interest rate environment. While dollar volumes were up quarter over quarter, interest earned on the balances was significantly lower as reflected in the decline in the net interest margin from 3.21% to 2.32%. Partially offsetting these impacts was a positive change in the provision for credit losses of $925,000 quarter over quarter reflecting excellent credit quality and improved economic conditions.

Consolidated operating expenses decreased $404,000, or 1.4%, primarily as a result of the pandemic-related decline in travel and other business development activities.

“Despite the pandemic and historically low interest rates, Cass has been able to steadily grow its customer base, revenue and earnings since the second quarter of 2020,” noted Eric H. Brunngraber, Cass chairman and chief executive officer. “These achievements are a testament to the ability of our team to innovate and successfully adapt when faced with an uphill challenge.”

Cash Dividend Declared

On April 20, 2021, the company’s board of directors declared a second quarter dividend of $.27 per share payable June 15, 2021 to shareholders of record June 4, 2021. Cass has continuously paid regularly scheduled cash dividends since 1934.

About Cass Information Systems

Cass Information Systems, Inc. is a leading provider of integrated information and payment management solutions. Cass enables enterprises to achieve visibility, control and efficiency in their supply chains, communications networks, facilities and other operations. Disbursing more than $60 billion annually on behalf of clients, and with total assets of $2 billion, Cass is uniquely supported by Cass Commercial Bank. Founded in 1906 and a wholly owned subsidiary, Cass Bank provides sophisticated financial exchange services to the parent organization and its clients. Cass is part of the Russell 2000®. More information is available at www.cassinfo.com.

Visit our Investor Relations site for more information

Topics: Company News